Examine This Report about Paul B Insurance Medicare Part D Huntington

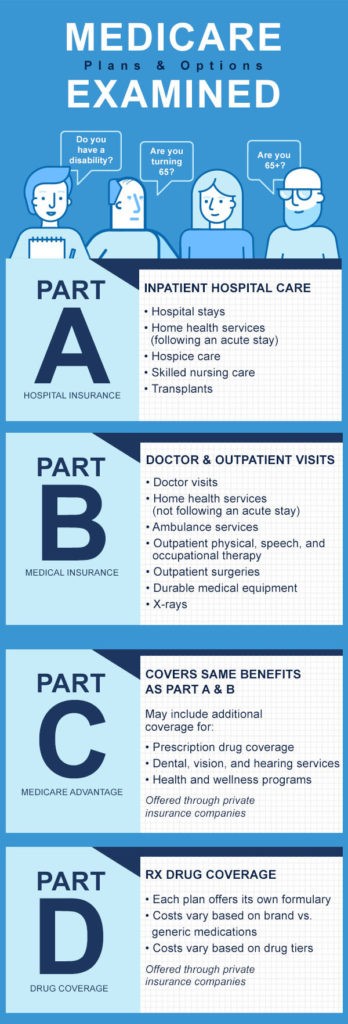

It assists you pay for outpatient services like doctor's office sees, precautionary care, a yearly health visit, physical treatment, psychological wellness treatment, lab services, and X-rays. As with Part A, if you're currently getting Social Security benefits, you'll automatically be registered partially B. Social Security will normally send your Medicare card 4 months prior to the month you turn 65.

Things about Paul B Insurance Medicare Insurance Program Huntington

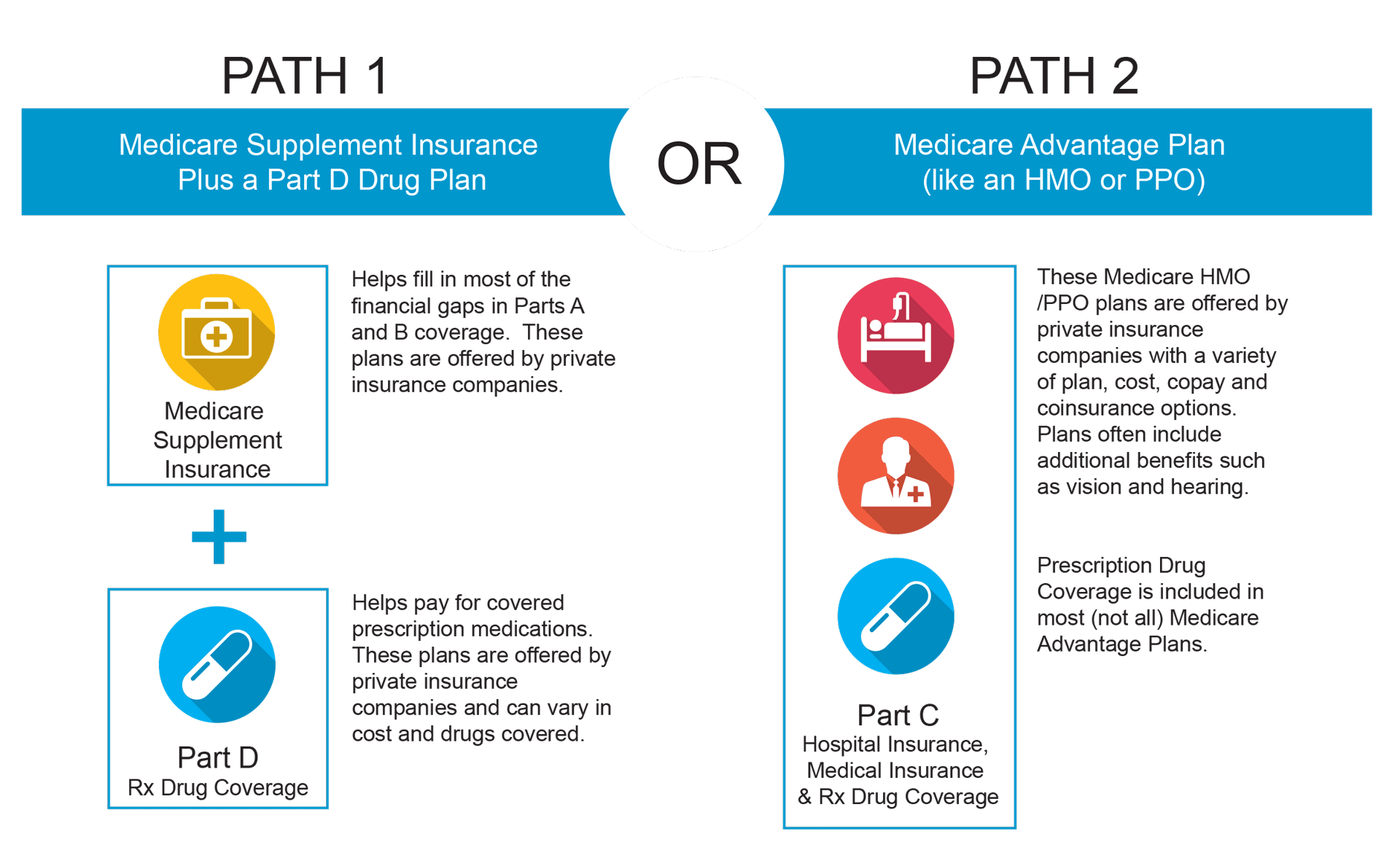

Medicare Advantage is an all-in-one plan that packages Initial Medicare (Component An and Part B) with fringe benefits. Kaiser Permanente Medicare health insurance are instances of Medicare Benefit strategies. Keep in mind that you need to be enlisted partially B and eligible for Part A before you can enroll in a Medicare Benefit strategy.

Paul B Insurance Medicare Agent Huntington Can Be Fun For Everyone

You can enlist in a stand-alone prescription drug strategy if you have Original Medicare. If you pick a Medicare Benefit strategy (Component C), your protection might include prescription medicine expenses (Component D). Your Part D costs will depend on which prepare you choose. If you're on a limited revenue, you might qualify for Bonus Help, a Medicare program that aids you pay for some or many prescription drug costs, including regular monthly costs, yearly deductibles, and also copays.

Like Component B, you could be billed an ongoing charge if you enroll in Component D late.

Because of hostile automated scuffing of and also e, CFR.gov, programmatic accessibility to these sites is limited to accessibility to our considerable designer APIs. If you are human individual obtaining this message, we can include your IP address to a set of IPs that can access Federal, Register. gov & e, CFR.gov; finish the CAPTCHA (robot test) listed below and also click "Request Accessibility".

The Buzz on Paul B Insurance Local Medicare Agent Huntington

An official site of the United States government. If you intend to ask for a broader IP variety, very first request accessibility for your existing IP, and afterwards utilize the "Website Responses" switch located in the lower left-hand side to make the request.

the State Medical Insurance Help Program (SHIP) for free, impartial info and also support. You can look at this now download and install a flyer that ideal explains Medicare Open Enrollment . Products concentrate on understanding the adjustments you can make throughout Medicare's Open Enrollment Duration, assessing your existing Medicare health and medication protection, and understanding how to make adjustments to your Medicare health and wellness and also drug protection. paul b insurance medicare advantage plans huntington.

Take a look at your plan's information to make certain your medicines are still covered as well as your medical professionals are still in-network. Medicare health as well as medication plans change annually therefore can your wellness requirements. Do you need a brand-new health care medical professional? Does your network consist of the expert you want for an upcoming surgery? Is your new drug covered by your existing strategy? Does another plan offer the same value at a reduced price? Analyze your wellness condition and also identify if you need to make a modification.

Paul B Insurance Medicare Insurance Program Huntington Can Be Fun For Everyone

To do this, see Medicare. gov or make a consultation with a neighborhood State Health Insurance Help Program (SHIP) therapist. Starting in October, you can utilize Medicare's plan finder device at to see what other strategies are supplied in your location. A brand-new plan might: cost less, cover your certain drugs, consist of service providers you desire, like your medical professional or drug store.

Bear in mind, during Medicare Open Enrollment, you can determine to remain in Original Medicare or sign up with a Medicare Advantage Strategy. If you're already in a Medicare Advantage Plan, you can change back to Original Medicare. The Medicare Plan Finder has actually been upgraded with the existing Star Rankings for Medicare health and wellness and also prescription medication strategies.

Utilize the Star Rankings to contrast the quality of health and also drug plans being offered.The State Medical insurance Assistance Program (SHIP) uses free, objective support in all 23 counties and Baltimore City with in-person internet and telephone aid. Volunteer chances are also readily available. To learn more regarding SHIP, pick a classification listed below.

Some Ideas on Paul B Insurance Medicare Agency Huntington You Need To Know

the State Health And Wellness Insurance Help Program (SHIP) for free, impartial information as well as support - paul b insurance medicare insurance he has a good point program huntington. You can download and install a leaflet that ideal explains Medicare Open Registration . Products concentrate on recognizing the adjustments you can make throughout Medicare's Open Enrollment Duration, reviewing your present Medicare wellness as well as drug protection, and recognizing exactly how to make modifications to your Medicare health and wellness as well as medicine coverage.

Consider your plan's details to ensure your medications are still covered as well as your medical professionals are still in-network. Medicare wellness as well as drug strategies alter yearly therefore can your health and wellness demands. Do you require a new health care doctor? Does your network consist of the specialist you want for an upcoming surgery? Is your new medication covered by your present strategy? Does one more plan supply the exact same value at a lower expense? Take stock of your health standing and also figure out if you require to make a change.

To do this, see Medicare. gov or make an appointment with a neighborhood State Medical insurance Assistance Program (SHIP) therapist. Beginning in October, you can utilize Medicare's strategy finder device at to see what other strategies are used in your area. A new plan may: expense much less, cover your particular medicines, consist of service providers you desire, like your medical professional or pharmacy.

The Buzz on Paul B Insurance Insurance Agent For Medicare Huntington

Keep in mind, during Medicare Open Enrollment, you can decide to stay in Original Medicare or sign up with a Medicare Advantage Strategy. If you're currently in a Medicare Advantage Strategy, you can switch over back to Original Medicare. The Medicare Plan Finder has been upgraded with the present Star Ratings for Medicare health and prescription medicine plans.

Utilize the Star Scores to compare the top quality of health and wellness and also medication plans being offered.The State Medical insurance Assistance Program (SHIP) provides totally free, unbiased support in all 23 areas and also Baltimore City with in-person as well as telephone aid. Volunteer possibilities are also readily available. For additional information concerning SHIP, choose a classification below.